Courses Infomation

J.L.Lord – Options Professional Online Webinar (2010-01 – 2010-02)

J.L.Lord – Options Professional Online Webinar (2010-01 – 2010-02)

J.L.Lord – Options Professional Online Webinar (2010-01 – 2010-02)

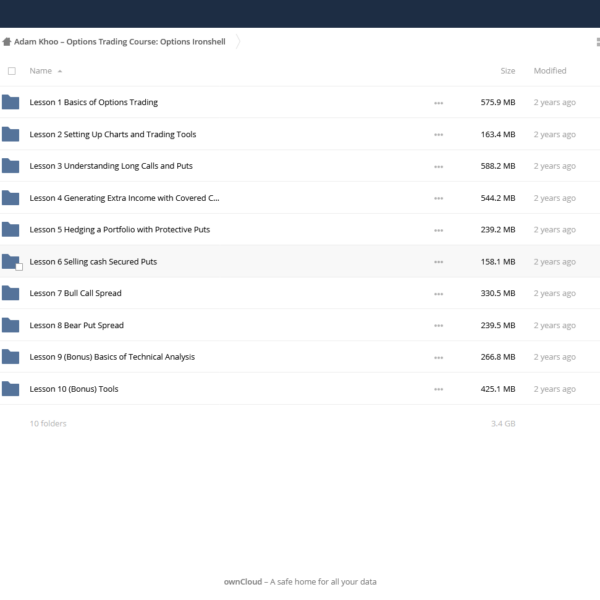

for content, please see screenshort.

Content:

Definition

A four-leg box amputee is known as a three-leg box. For a number of potential reasons, one conventional box piece has not been swapped. The two main reasons to be in a three-leg box are not selling one of the options (which should typically be sold) to enhance potential profit, or not buying a leg (which should be bought to raise possible reward but assuming greater risk).

Definition

The box serves as the foundation of option arbitrage. The box often depicts a collection of connections that permanently bind the love triangle between calls, puts, and stocks.

Relationship Sets

Short put with long call equals long synthetic stock. A trader who purchases a call and sells a put with the same strike and expiry month ends up with a position that, in most cases, resembles a long stock position at the relevant strike and for the remaining time until expiration.

Long Put + Short Call = Short Synthetic Stock. A trader who sells a call and purchases a put with the same strike and expiry month ends up in a position that, in most cases, resembles a short stock position at the relevant strike and for the remaining period till expiration.

The Greeks of Option

This guide deconstructs and demystifies the Greeks, the most perplexing of all option ideas (Delta, Gamma, Theta, Vega, and Rho). For individuals who want to push the boundaries of their alternative education, this is a sophisticated text. Even the most experienced professional floor traders will probably pick up something from this wealth of information, despite the fact that it is written such that the average person can grasp it easily. When every deal seems to work against you, how often have you wished you had this information?

The information provided is not only theoretical; rather, it applies Greek practicality to those theories to create market-profitable solutions. Find out how experienced traders may purchase or sell straddles and strangles while taking advantage of time decay even when they are required to pay out the time decay. This is the quantitative trading handbook for the analytical trader, but it is written in a way that even those without a strong foundation in complex mathematics can grasp it. Without this book, no trade library is complete. What would having a panic button available to you be worth to you personally and financially? Without understanding the concepts provided here, many people have paid over $20,000 for specialist options training.

About

For students who want to turn their enthusiasm for trading into a career, Random Walk Trading was founded as a premier options trading education company. As a result, we only want to deal with those that are committed to their education.

Salepage : J.L.Lord – Options Professional Online Webinar (2010-01 – 2010-02)

![[Bundle Video Course] Derek Rake - 2 Courses (Free Upgrade New Course) of https://crabaca.store/](https://crablib.info/wp-content/uploads/2022/09/4992706b24219f547b.jpg)

Reviews

There are no reviews yet.