Courses Infomation

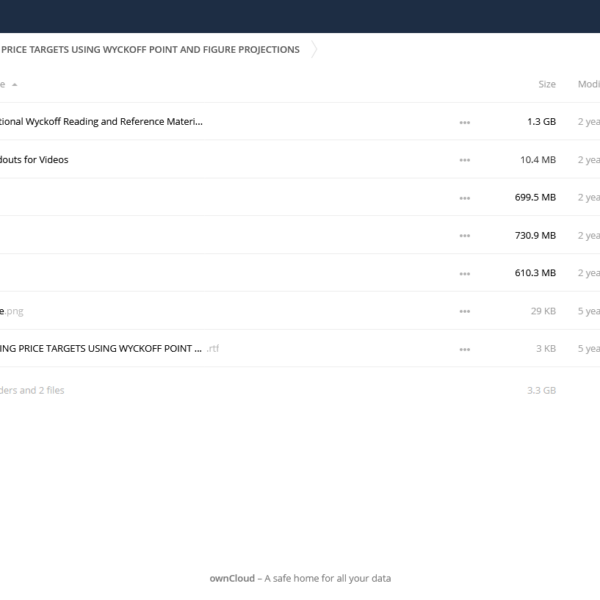

Wyckoff VSA – Point and Figure Mentorship Course

Wyckoff VSA – Point and Figure Mentorship Course

Archive : Wyckoff VSA – Point and Figure Mentorship Course

Tradeguider overview :

Volume spread analysis (VSA) is a unique trading methodology that is neither technical analysis nor fundamental analysis.

VSA is able to identify the activities of the “Smart Money” – the institutional investors, hedge funds, investment banks – and enable you to trade in harmony with them.

Whether you trade stocks, futures, forex, commodities or options, Volume Spread Analysis will help you bring real clarity to the markets.

Tradeguider offers access to the VSA methodology through trading software tools, education, live trading rooms and trade alerts, all designed to show traders and investors how to start investing or trading.

The software tools plug into many of the most popular trading platforms, including MT4, NinjaTrader, TradeStation, Sierra Chart and Metastock. Tradeguider’s mission is to help and enlighten traders and investors at every stage of their development to even the odds in all markets and for any time-frame.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Wyckoff VSA – Point and Figure Mentorship Course

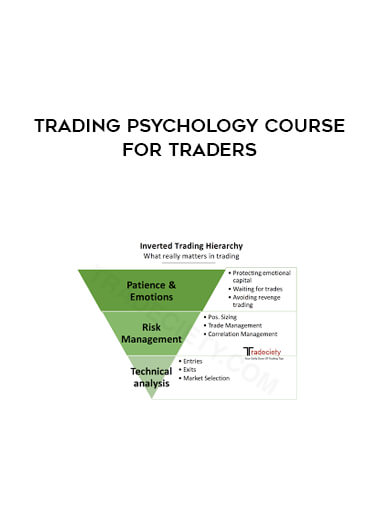

More From Categories : Wyckoff – Trading Psychology Courses

Curriculum:

160:” “;}}

“;}}

![Mark Douglas - Trading Psychology [4 mp3] of https://crabaca.store/](https://crablib.info/wp-content/uploads/2022/01/Mark-Douglas-Trading-Psychology-4-mp3-600x600.jpg)

Reviews

There are no reviews yet.