Courses Infomation

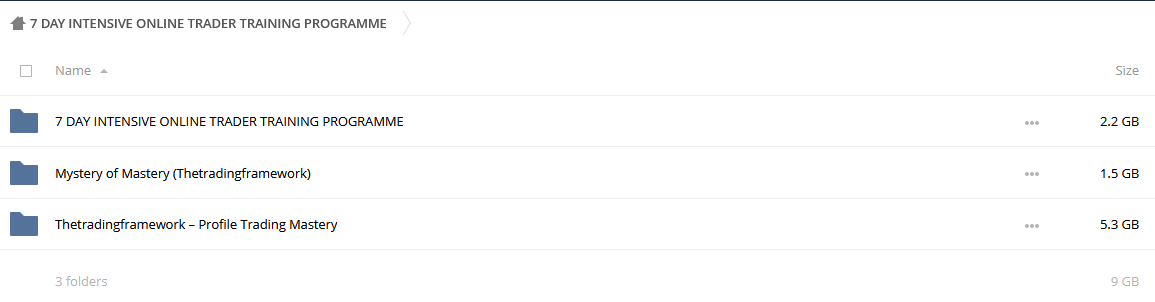

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME

Archive : 7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME

Save 500 GBP ! – For a limited time 1000 GBP instead of 1500 GBP

RECENTLY RECORDED LIVE EVENT COMPLETED: Saturday 11th March 2017 until Friday 17th March 2017.

ALL 7 DAYS NOW AVAILABLE TO VIEW INSTANTLY ONLINE!

After over 15 years of day trading myself and over 10 years of coaching experience working with traders from all walks of life, I have decided it was time to launch the most comprehensive, and complete online training programme.

This includes Training of concepts and trading strategies, however most importantly 5 days of live trading examples of how to apply what was taught in the first 2 days. For many years’ traders, have said that it would be great to watch over me as I do my thing each day in the European and US markets.

I will cover Intra-Day Swing Trading as well as Scalping, just as I practice right now. Coverage of Euro Bund, EuroStoxx 50, Dax, Mini-Dax, E-mini S&P, Mini Dow, Mini Nasdaq and Crude Oil.

Here is how the days are broken down with times in GMT (London)…

2 DAYS RESERVED FOR:

• Complete and thorough Understanding of Auction Market Theory, MarketVolume profile and the Trading Framework Concepts.

• An in-depth overview and explanation of the process of Planning, Analysis through to execution and trade management.

5 DAYS OF LIVE PLANNING, ANALYSIS AND TRADING EXAMPLES:

DAY 1

1pm GMT – Introduction

1.20pm – Auction Market Theory and the Negotiation Process

2.30pm – Reading Price Action and Volume Profiles.

3.30pm – Break

4.15pm – Understanding and finding Value in the Markets to suit your Objectives.

5pm – Importance of the Fractal nature of Stage and Cycles in the markets.

5.30pm – Market Harmonics and Fibonacci Analysis

6.15pm – Example Framework Applications

7.15pm – Review of Key Concepts with Q and A.

DAY 2

1pm GMT – Review of Yesterday’s Key Points

1.20pm – Timing and Execution Process

2.30pm – Reading Order Flow Dynamics

3.30pm – Break

4.15pm – Reading the DOM, Footprints, Jigsaw and other tools.

5pm – Risk Management Strategies

5.30pm – Position Sizing and Creating Dynamic Risk and Position Sizing Plans.

6.15pm – Trade Management Strategies

7.15pm – Review of Key Concepts with Q and A.

DAY 3-DAY 7 (TOTAL 5 DAYS)

6.30am GMT – Pre-Market Analysis performed LIVE ahead of the European Market Open as Kam prepares to trade the Euro Bund and EuroStoxx 50

10.00am – Application of concepts for Scalping Mini-Dax.

11.00am – Break until US Markets Session.

1.30pm– Pre-Market Analysis performed LIVE ahead of the US Market Open as Kam prepares to trade the Emini S&P, Mini-Dow, Nasdaq andor Crude Oil.

4.00pm – Close of Trading session for entries and new trades, existing trades will remain open and discussed.

4.10pm – Review of Analysis, Trades etc with Q and A.

TO GET ACCESS: Simply checkout by choosing and option on the right for our standard payment system (Stripe) OR use PayPal payment option with the button below:

For a limited time SAVE £500 GBP

Just £1000 GBP instead of 1500 GBP

What Is Technical Analysis?

Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

Unlike fundamental analysis, which attempts to evaluate a security’s value based on business results such as sales and earnings, technical analysis focuses on the study of price and volume. Technical analysis tools are used to scrutinize the ways supply and demand for a security will affect changes in price, volume and implied volatility. Technical analysis is often used to generate short-term trading signals from various charting tools, but can also help improve the evaluation of a security’s strength or weakness relative to the broader market or one of its sectors. This information helps analysts improve there overall valuation estimate.

Phân tích kỹ thuật có thể được sử dụng trên bất kỳ bảo mật nào với dữ liệu giao dịch lịch sử. Điều này bao gồm cổ phiếu, hợp đồng tương lai, hàng hóa, thu nhập cố định, tiền tệ và các chứng khoán khác. Trong hướng dẫn này, chúng tôi thường phân tích cổ phiếu trong các ví dụ của chúng tôi, nhưng hãy nhớ rằng những khái niệm này có thể được áp dụng cho bất kỳ loại bảo mật nào. Trên thực tế, phân tích kỹ thuật phổ biến hơn nhiều trong thị trường hàng hóa và ngoại hối, nơi các nhà giao dịch tập trung vào biến động giá ngắn hạn.

Salepage: 7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME

Xem thêm từ danh mục: Technical Analysis Courses

Curriculum:

158:” “;}}

“;}}

Reviews

There are no reviews yet.