Courses Infomation

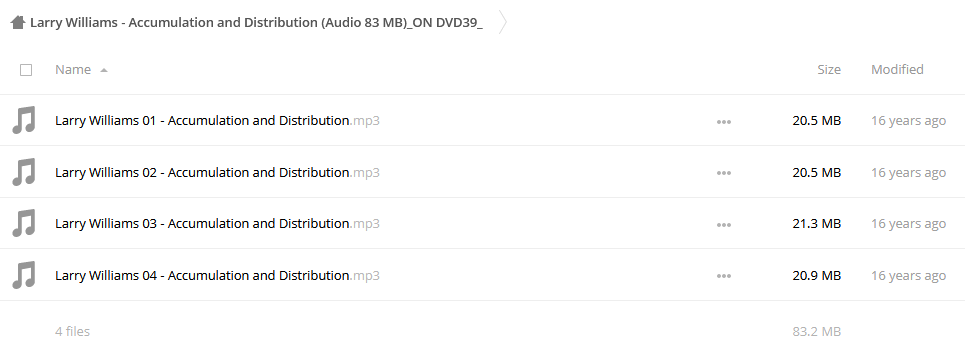

Accumulation & Distribution by Larry Williams

Accumulation & Distribution by Larry Williams

Forex Trading – Foreign Exchange Course

You want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

The Williams’ accumulation/distribution indicator can be used to measure buying and selling pressure within the financial markets. The use of this momentum oscillator can help you determine appropriate times for entering or exiting a specific market position.

Security: WMT

Position: N/A

| The Williams’ accumulation/distribution (WAD) indicator is a momentum oscillator that measures buying and selling pressures. Accumulation refers to a rising market, with increased buying pressure meaning the buyer is in control. Conversely, distribution is associated with declining markets and selling pressure with the sellers in control. This indicator is one of many developed by technical analyst, Larry Williams. Unlike many of the other accumulation/distribution indicators, such as on-balance volume and the Chaikin oscillator, the WAD doesn’t factor in volume. If you do want to include volume data when using this indicator, some software packages have a volume-weighted WAD.Calculating the Williams’ accumulation/distribution value begins with determining the true range high (TRH) and true range low (TRL):TRH = Yesterday’s close or today’s high, whichever is greater TRL = Yesterday’s close or today’s low, whichever is greaterThen, determine the WAD value for today:If today’s closing price is greater than yesterday’s closing price, Today’s WAD = Today’s close – TRL Otherwise, if today’s closing price is less than yesterday’s closing price, Today’s WAD = Today’s close – TRH Otherwise, if today’s closing price is equal to yesterday’s closing price, Today’s WAD = 0The final cumulative value can then be calculated for the WAD:WAD = Today’s WAD + Yesterday’s WAD |

| Buy and sell signals will occur when there is divergence between price data and the WAD indicator. For example, if a security’s price is setting a new high and the WAD indicator is not setting a new high, then a sell signal will be generated. If a security’s price is setting a new low and the WAD indicator does not correspond with its own low, then a buy signal is generated. |

| Figure 1: Daily price chart for Wal-Mart Stores, Inc. plotted with the Williams accumulation/distribution indicator. |

| Graphic provided by: TradeStation. |

| Once a buy or sell signal is created with the WAD line, it is a good idea to wait for a confirmation of that signal. One fairly easy method for doing this would be to draw a trendline on the WAD. Once this trendline is broken, the signal will be confirmed and you can enter a market position with greater confidence. |

| In the daily price chart for Wal-Mart Stores, Inc. [WMT], a sell signal is created at the arrow labeled 1. At this point, the price has reached a new high, while the WAD line has not. Since the upward trend (line AB) has just been broken to the downside, this would signify an excellent point for exiting a long position or entering a short position. The opposite situation develops at the arrow labeled 2. Here, the price chart has made a new low but the WAD line has not. This divergence signals a buy opportunity. When the WAD line breaks above the downward trendline (line CD) the buy position is confirmed. |

Salepage : Accumulation & Distribution by Larry Williams

About Author

1962 was when Larry began following the markets. His interest was sparked by the Kennedy market crash, when President Kennedy forced a roll back in steel prices. The crash was front page news everywhere. People lost millions but Larry was more taken by the fact that if you had been “short” the market, you would have made millions.

Larry began to understand that he could make a $100 day trading the markets, whether the market was going up or down. He was smitten. To a 20 year old college kid, $100 bought a lot of beer and pizza. Larry Williams graduated from the University of Oregon in 1964 with a bachelors in Journalism, thus his passion for writing.

By 1965 Larry was actively trading the markets and began writing a newsletter as well. It wasn’t long before Larry began producing ground breaking market research. In 1966 Larry developed his famous timing tool, Williams Percent R. This tool still is published daily in many major financial papers and is a standard indicator provided on trading web sites, software, and apps around the world.

On the Campaign Trail with President Reagan

In 1970 his first investment book, “The Secret of Selecting Stocks For Immediate and Substantial Gains”, was published. Larry followed that with the first book ever on the seasonality of stocks and futures, “Sure Thing Commodity Trading, How Seasonal Factors Influence Commodity Prices”.

In between trading, researching and developing trading tools, teaching, and writing, Larry managed to run twice for the U.S. Senate as well as 76 marathons.

Larry with President Reagan 1987 on Air Force One

Larry’s long list of best-selling books includes 1982’s “How to Prosper in the Coming Good Years” which accurately forecast the largest bull market and surge in economic growth in American history. He is a past board member of the National Futures Association and the recipient of numerous awards, including Futures Magazine’s first Doctor of Futures Award, the Omega Research Lifetime Achievement Award, Significant Sig (a Sigma Chi acknowledgement), Traders International 2005 Trader of the Year, on October 6, 2002 the mayor of San Diego declared that day as Larry Williams’ Day, and 2014 MTA (Market Technicians Association) Man of the Year Award.

More From Categories : Forex Trading Courses

Curriculum:

155:” “;}}

“;}}

Reviews

There are no reviews yet.