Courses Infomation

Day Trading and Swing Trading Strategies For Stocks By Mohsen Hassan

Day Trading and Swing Trading Strategies For Stocks By Mohsen Hassan

**More information:

Description

- Different Day Trading And Swing Trading Strategies That You Can Implement Today

-

THE PROCESS OF DEPLOYING A TRADING STRATEGY

-

HOW TO SCREEN FOR STOCKS FOR A GIVEN STRATEGY

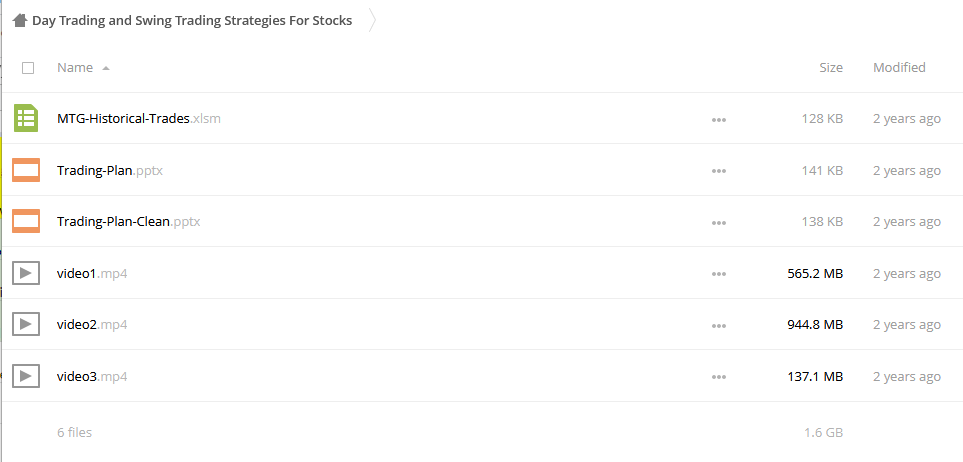

- Have Access to Excel Sheet To Historical Trading Performance Analysis

- This is a follow up race to the race “Stock Market Trading Foundation” & “Advanced Stock Trading Course + Strategies”

- Fundamental Analysis, Risk Management, Money Management & Trading Psychology, You can still do this race!

In this race you will learn Day Trading and Swing Trading Strategies from the CEO of a Trading Firm.

You will learn about the process involved in building a Successful Trading Strategy. From generating trading ideas, to researching those ideas, finding patterns, testing them and finally running the strategy.

This course will teach you this process by going over several Strategies. By doing this you will not only learn about a profitable trading strategy, but you will also discover new strategies that you can implement.

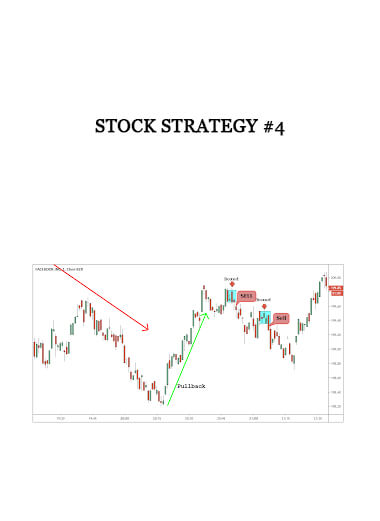

The current strategies in this race are:

- Opening Price Gap Strategy

- Equity Dilution Strategy

- Dividend Cut Strategy

You will also receive a free sheet of paper that you can use to analyze your historical trading performance .

You will also get access to a Shareable Web site. This will help you find the best possible resources regardless of which country you are trading in.

Furthermore, you will get plenty of insight that will help you in increasing your level of success! See you Inside ?

Stock trading course: Learn about Stock trading

A stock trader or equity trader or share trader is a person or company involved in trading equity securities.

Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker.

Such equity trading in large publicly traded companies may be through a stock exchange.

Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets.

Stock traders can trade on their own account, called proprietary trading, or through an agent authorized to buy and sell on the owner’s behalf.

Trading through an agent is usually through a stockbroker. Agents are paid a commission for performing the trade.

Major stock exchanges have market makers who help limit price variation (volatility) by buying and selling a particular company’s shares on their own behalf and also on behalf of other clients.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Day Trading and Swing Trading Strategies For Stocks By Mohsen Hassan

About Author

For the past 10 years, Mohsen has been heavily immersed in every aspect of trading. He has worked with/in a multitude of successful traders, proprietary trading groups, Hedge funds and Banks. He has filled several positions ranging from a discretionary trader, automated trader, quant, risk manager and programmer. He has backtested, automated and traded strategies ranging from long-term to High-Frequency black boxes that have been collocated near the exchange.

He has developed advanced knowledge in every area of trading and is considered an expert in the area of market microstructure and automation. Mohsen has started bloom trading because of his passion not only for trading but to teach others the art of trading and to build a community of like-minded people that share the same goals and values.

More From Categories : Forex – Trading & Investment

Curriculum:

155:” “;}}

“;}}

Reviews

There are no reviews yet.