Courses Infomation

Price Ladder Training

Price Ladder Training

Archive : Price Ladder Training

A MESSAGE FROM

YOUR MENTOR

The Price Ladder Training programme was developed with a vision in mind. That vision was to cause a paradigm shift in trader development, by providing a platform for traders of all experience levels to rapidly hone the invaluable skillset of reading order-flow in the financial markets. By training them how to read order-flow, our ultimate objective is to create the next generation of great traders.

With our intensive simulated Trading Drills, the programme utilizes our proprietary FutexLive Replay technology to rapidly accelerate your understanding of how to trade order-flow patterns, using institutional Level II trading software commonly known as the “Price Ladder”. The Price Ladder is our traders’ number one execution platform and is the most effective way to profit from major event-driven risks and specific order flow patterns, which are Futex’ most profitable setups.

The programme has been created so that it exposes you to the fundamental elements of the market; buyers and sellers. It is geared towards accelerating your learning curve in the art of basic of order-flow and also the science behind trading the most volatile risk events, in order to profit from them as our professional traders do. All of our traders undergo the intensive Price Ladder Training, which ultimately gives them a much greater chance of reaching a consistently profitable performance.

OUR CORE BELIEFS

If the ethos of this programme could be summed up in just two words, those words would be: deliberate practice.

Deliberate practice is a hallmark of expert performers where through guided practice, experts open themselves to feedback and, as a result, become better decision makers. Discretionary traders are often compared to athletes, where their ultimate pursuit is high performance. Not only do they both have to constantly deal with the inherent issues of unrelenting pressure, performance slumps, confidence issues, and changing motivational factors, but they also have to build the skillset to be able to perform almost instinctively.

We often hear the phrase “practice makes perfect,” but performance experts in sports emphasize that it is perfect practice that makes perfect. How practice time is structured makes the difference between a performer with 10 years of experience and one who has a single year of experience repeated 10 times over. Quality of the practice is just as important as the quantity of practice.

Over the many years of discretionary trading, there has been a vast improvement in the educational field of trading and FutexLive has always strived to be at the forefront of trader training and development. In light of this, we have worked diligently over time to develop one of the most innovative products in the field in order to accelerate a trader’s learning curve.

Working closely with EasyScreen, FutexLive has developed a price ladder environment that allows us to “Replay” the order flow at any point in time, during any trading day of the year. This has given us the unprecedented advantage of being able to practice or perform specific component Trading Drills, which in-turn can vastly increase a trader’s memory bank of order-flow patterns.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Price Ladder Training

More From Categories : Forex Trading Courses

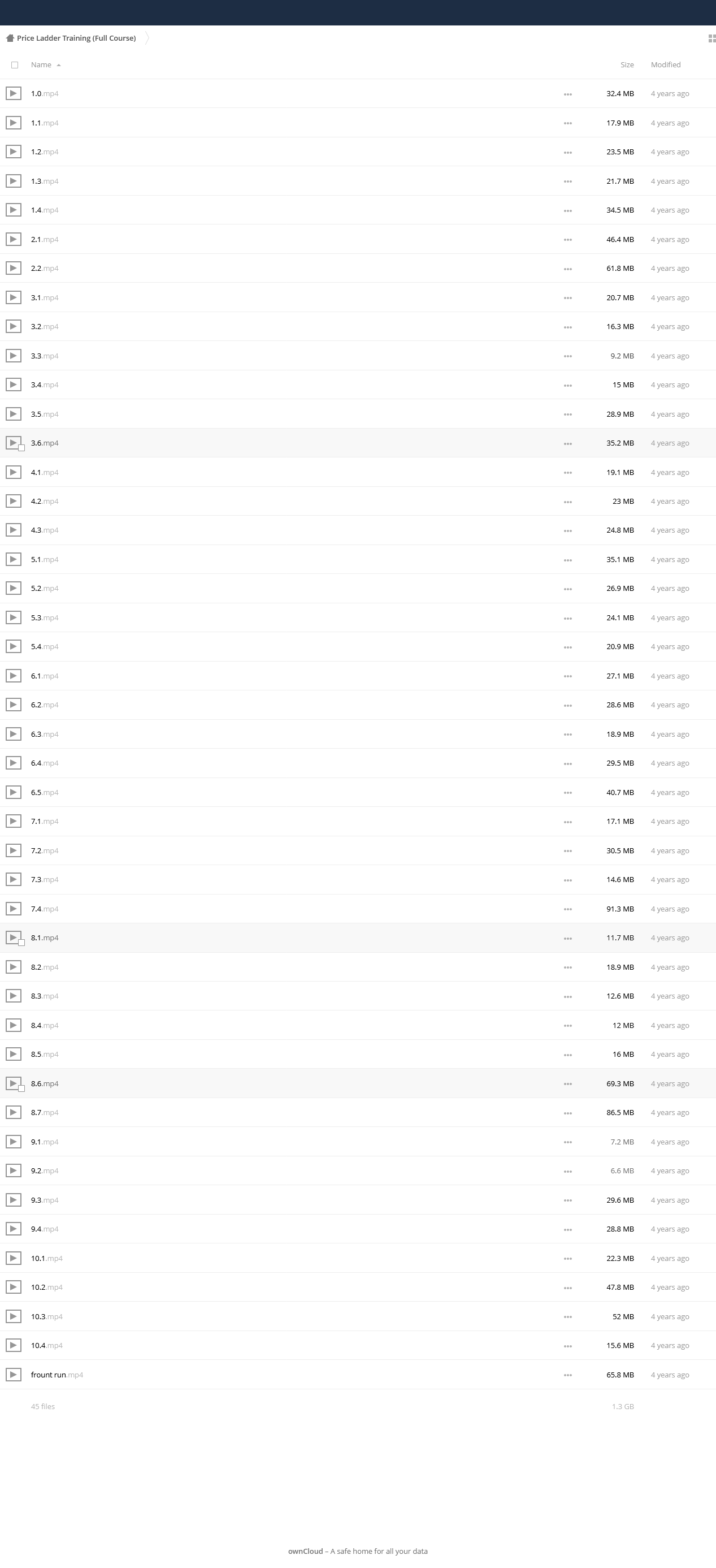

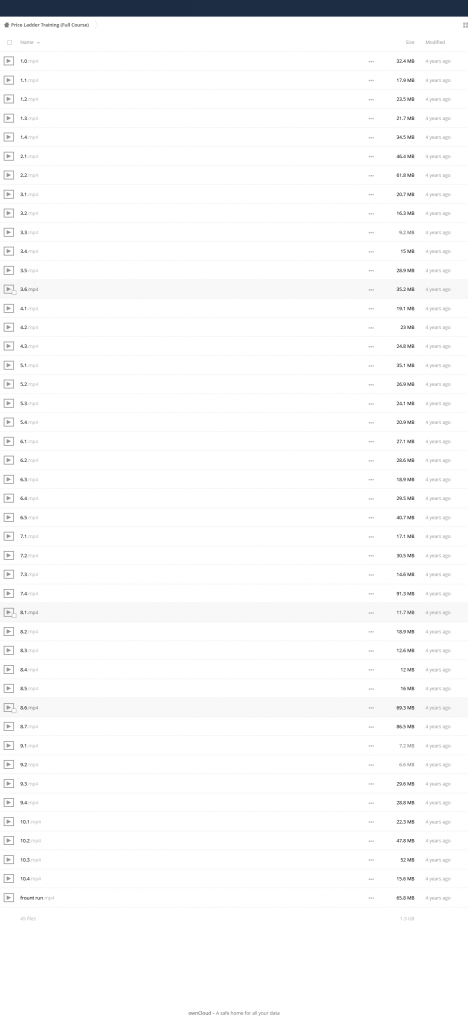

Curriculum:

195:” “;}}

“;}}

Reviews

There are no reviews yet.