Courses Infomation

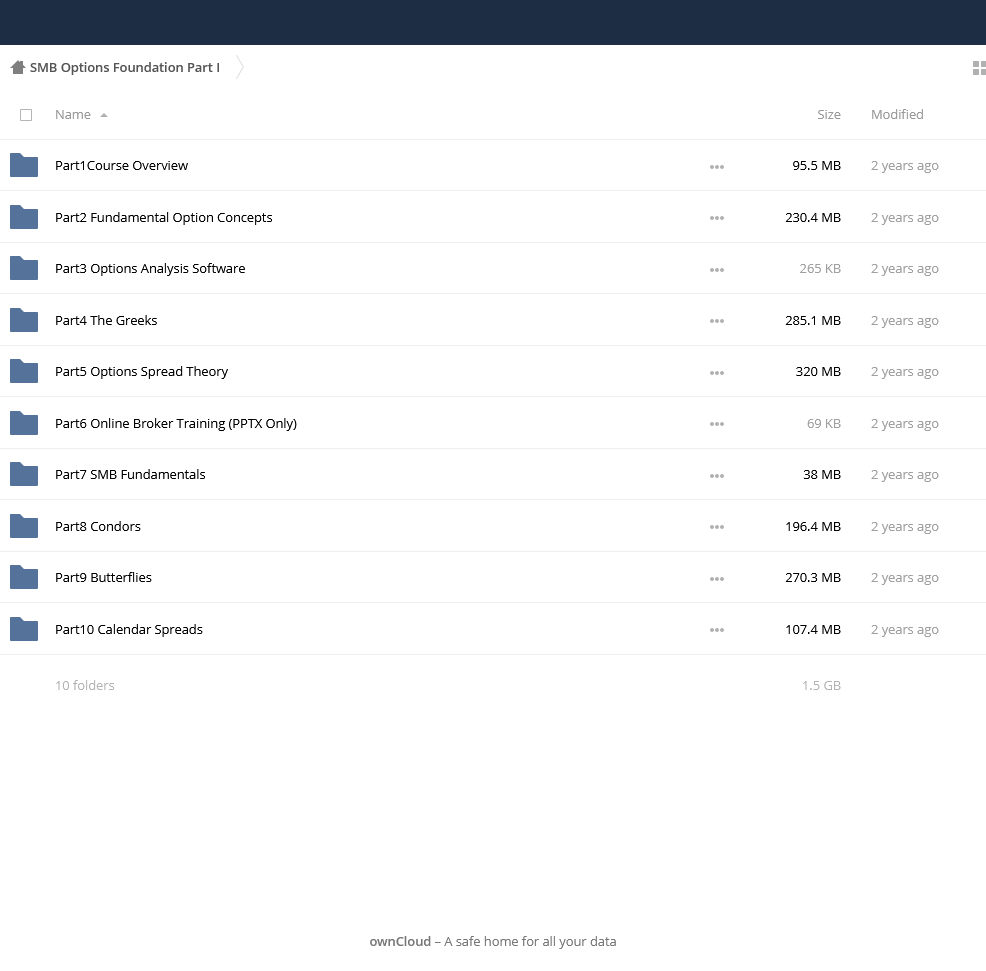

SMB Options Foundation Part I

SMB Options Foundation Part I

Archive : SMB Options Foundation Part I

Welcome to the SMBU

Options Trading Foundation Program

If you’re like most people we interview, your goal is to be an elite options trader. You picture yourself as someone who can be one of the best, you want options trading to be a career.The SMB Options Training Program is a unique process of education and skill development. After each student learns the core strategies and tactics, we work hard together to determine what works best for each student. When an options trader and the correct strategy are in sync, the trader will have the tools, conviction and confidence necessary to succeed.This program is for you if you’re looking for a systematic, efficient and affordable method to become an options trader who earns money. I say “affordable” because the cost of paying the market to learn can be quite expensive in both time, money and stress if you try it on your own.We are on the same options trading path. Our mentors are simply further down the road and are waiting to help you realize your goals. The comprehensive online video series, mentoring and the accompanying manual train the trader to create a complete personalized trading plan. The development of this focused skill-set and support from the SMBU community foster the ability required to be a professional trader. Depending on the trader development program you select, your trader path will include some or all of the following components:

- Instant access to the online video series.

- Sixty minute mentor session after one month.

- Over 400 pages of training material to accompany the videos (Parts one and two combined).

- Weekly student webinars to review the nuances of the strategies.

- Video archive of the student webinars to study at your convenience.

- Individual online mentoring, recorded for student review.

- Structuring your personalized playbook and options trading plan

Which of These Common and Costly Mistakes Have You Made?

Beyond Classroom Theory and into Career Opportunities

- Session 1: Course Overview: Gain a solid understanding of successful trading the importance of focusing on one good trade, the SMBU core philosophy.

- Session 2: Fundamental Option Concepts: Learn the cornerstone concepts such as strike price, what it means to buy or sell and the all-important premium.

- Session 3: Options Analysis Software: Learn how to place credit spread trades and how to back-test to explain why a trade made a profit or a loss.

- Session 4: The Greeks: How to measure the effect on changes in price, time and volatility.

- Session 5: Options Spread Theory: How to trade options for income and profit from time decay.

- Session 6: Online Broker Training: Introduction to five major online options broker platforms

- Session 7: SMB Fundamentals: SMBU believes that all successful traders follow certain fundamental principles and practices which if carefully applied will result ultimately in a successful trading track record. This section covers the seven principles of elite trading performance.

- Session 8: Condors: Learn the entry, exit and all important adjustment tactics for this most popular of options spread strategies

- Session 9: Butterflies: How to enter, adjust and exit iron, call side and put side butterflies—a powerful strategy for profiting from the high time decay of at-the–money short options.

- Session 10: Calendar Spreads: Popular and core strategy which takes advantage of the relative time decay of near and far term options. Learn how to enter, adjust and exit.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : SMB Options Foundation Part I

About Author

SMB

SMB Group defines the broader SMB market to include commercial companies with 1 to 999 employees, and upper midmarket with 1,000 to 2,500 employees. In reality, the SMB market is composed of many smaller, more discrete markets. It looks more like a thumbtack than the traditional triangle that is used to depict it. For instance, 72% of all businesses in the U.S. are home-based businesses, and 27.6% employ fewer than 100 employees.

Size, of course, is only one dimension in understanding SMB technology perspectives and behavior. Other key dimensions include industry focus, geography, the number of years in business,the age of the owner and other key decision-makers, and attitudes towards technology as a business enabler.

Within the SMB market, SMB Group’s areas of focus include: emerging technologies, business applications, social business, collaboration and productivity applications, cloud solutions, mobility, IT infrastructure management, managed services and channels.

More From Categories : Forex – Trading & Investment

Curriculum:

194:” “;}}

“;}}

Reviews

There are no reviews yet.