Courses Infomation

SMB – Super Simple Spreads by John Locke

SMB – Super Simple Spreads by John Locke

Archive : SMB – Super Simple Spreads by John Locke

In “Super Simple Spreads”, John Locke teaches you:

- Why traditional “high probability” options trades aren’t as great as they seem.

- How to properly calculate your odds in options trades… (hint: it’s probably not what you think)

- Why some high probability income strategies actually have worse probabilities than buy-and-hold strategies.

- How a proper management strategy can dramatically improve your probabilities of success over time

John Locke give you multiple trading plans in one course

Learn Super Simple Spreads Including:

- The Bull – Everything you love about high probability premium selling — plus everything you need to know to keep from blowing up your account. Learn the when, where, and how of selling high probability spreads, plus simple money management rules that have been back tested for success over 80% of the time.

- The Bear – A super simple spread trade that has a excellent risk:reward ratio, provides income in many market conditions, and particularly does well in a bearish trend.

- The Bull vs. Bear – A strategic combination of the first two Super Simple Spreads. Learn how these trades can work together to increase probabilities. Manage the trades independently depending on market conditions.

- The V-Condor – A Somewhat Simple Spread that provides an introduction to managing a trade based on the Greeks. Still a fully systematic trade that can be traded with once-per-day management and a list of rules.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : SMB – Super Simple Spreads by John Locke

More From Categories : Forex – Trading & Investment

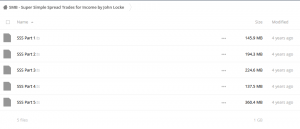

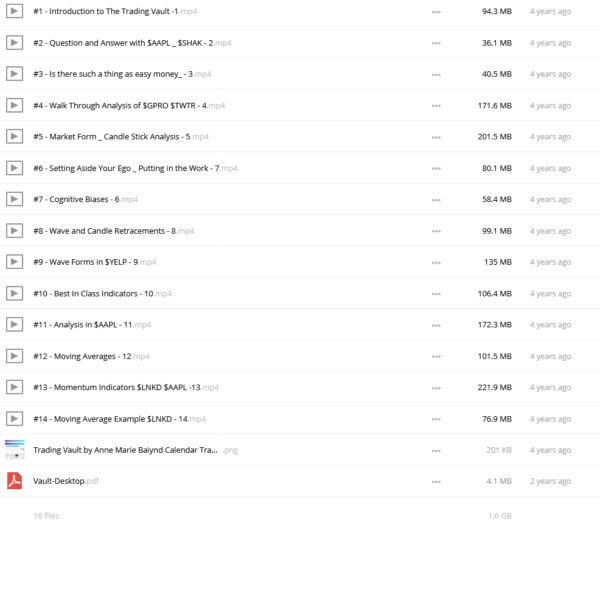

Curriculum:

156:” “;}}

“;}}

Reviews

There are no reviews yet.