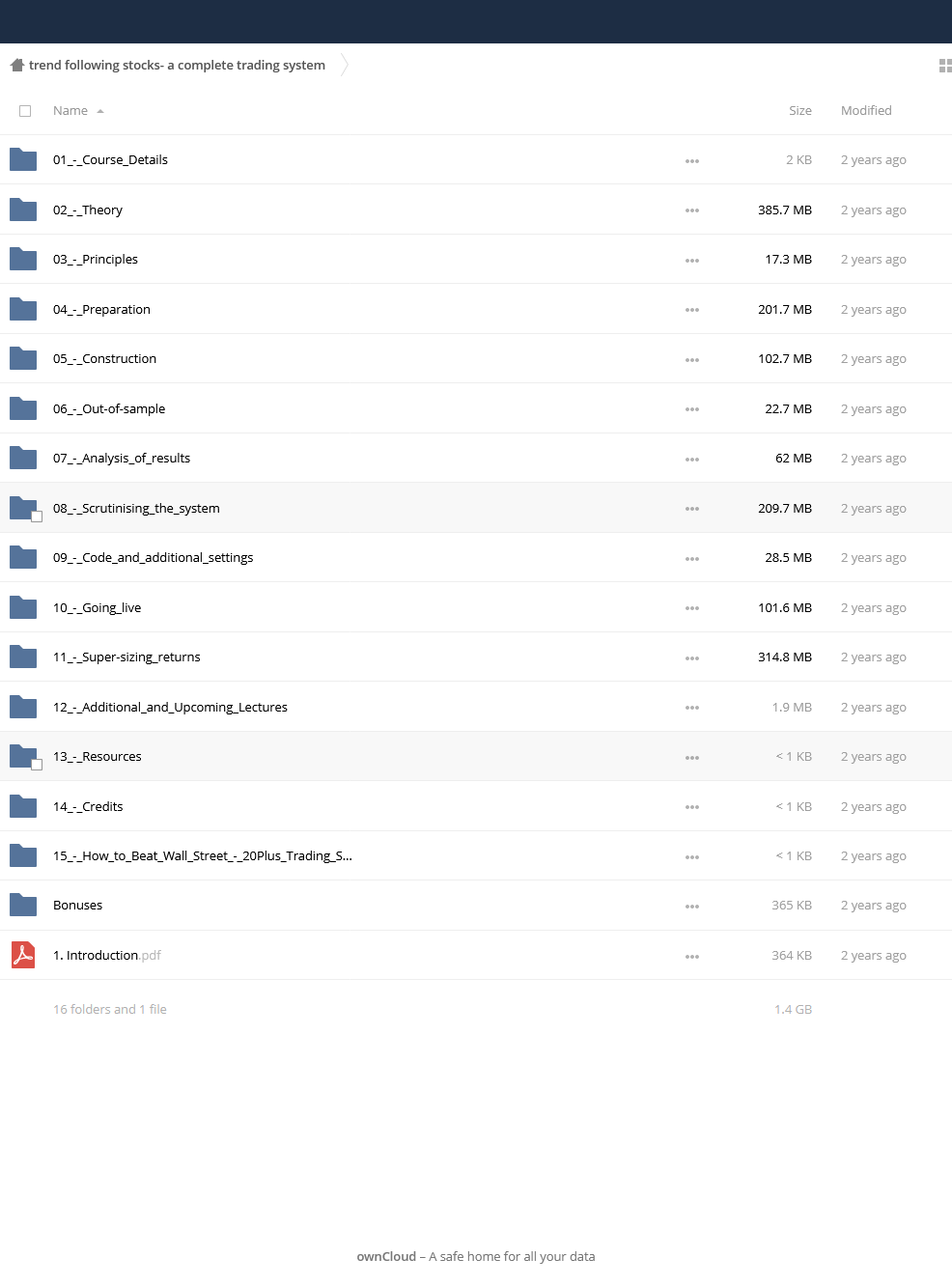

Courses Infomation

Trend Following For Stocks-A Complete Trading System by JB Marwood

Trend Following For Stocks-A Complete Trading System by JB Marwood

Stock trading course: Learn about Stock trading

A stock trader or equity trader or share trader is a person or company involved in trading equity securities.

Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker.

Such equity trading in large publicly traded companies may be through a stock exchange.

Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets.

Stock traders can trade on their own account, called proprietary trading, or through an agent authorized to buy and sell on the owner’s behalf.

Trading through an agent is usually through a stockbroker. Agents are paid a commission for performing the trade.

Major stock exchanges have market makers who help limit price variation (volatility) by buying and selling a particular company’s shares on their own behalf and also on behalf of other clients.

A complete trend following strategy that makes millions in stocks. Back-tested over 30 years of stock market data.

Course Description

• This is a complete trend following strategy for stocks.

• Incredible performance all the way back to 1986. [See the free preview below]

• All course updates completely free and always will be.

• Course optimised for mobile, tablet, and desktop. System code included.

“Trend following methods have been the simplest, most successful trading methods for decades” – Perry J Kaufmann

When it comes to beating the stock market, there are few strategies that can offer such consistent returns as the strategy of trend following.

Trend followers made a killing in 2008, when the whole financial system was in meltdown and they made millions in 2014, just when the sceptics were saying the strategy was dead. And some of the best trend following funds have been in operation for over 40 years, building up funds with billions of dollars in assets.

To be sure, most big trend following funds operate in the realm of managed futures but there is significant evidence that trend following can be applied just as successfully to stocks.

On this course, you will learn the full rules to an original trend following strategy that can be used in the stock market. Rules that anyone can master and put into practice with just a couple of hours work a week.

Who am I? My name’s Joe Marwood and I’m a trader originally from London, England. I’ve been trading trend following systems on stocks for years and over the next couple of hours, I will build and then disclose this complete trend following strategy for stocks that has been rigorously tested on historical stock market data going back to 1986.

I go through the fundamentals of trend following, the theory, the secrets, and the steps necessary to build a robust and reliable trend trading strategy.

I also record live system back-tests so you can see the real, unaltered, system results and the system equity curve for yourself.

This is a strategy that is simple enough for any investor to understand yet sophisticated enough to show incredible annual returns versus the benchmark. It’s a strategy that has been able to capture some huge multi-week trends in some of the best stocks on the market. And this strategy can be applied to other global stock markets too.

The trend following for stocks strategy is suitable for:

• Full-time and part-time traders.

• Investors seeking to diversify their existing portfolios.

• Traders and investors looking to passively build wealth and income.

• Those seeking alternate investment strategies.

As you may have guessed, this is not another get rich quick scheme or day trading system with a high failure rate. Rather, this is a straightforward and mechanical approach to following trends in stocks designed to compound your wealth and beat the market.

Stop following the news and start following the trend today.

Make sure you check out the free preview to see the equity curve for this trend following system and to see some of the system’s best stock wins.

What are the requirements?

- Some basic understanding of stock market terms.

What am I going to get from this course?

- Over 65 lectures and 3.5 hours of content!

- Full system code and rules for a complete trend following trading system.

- In-sample and out-of-sample results of the system.

- Education in trend following theory, performance, and fundamentals.

- Closed captions subtitles for reinforced learning.

What is the target audience?

- This course is suitable for anyone with an interest in trading and beating the market using a unique, rarely talked about strategy.

- The goal of this course is to provide a complete trend following system and to show live back-test results.

- The goal of this course is to provide a complete trend following system and to show in live testing how the strategy has performed over reliable, historical data.

What is Stock?

Stock (also capital stock) is all of the shares into which ownership of a corporation is divided. In American English, the shares are collectively known as “stock”. A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the stockholder to that fraction of the company’s earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued for example without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Salepage : Trend Following For Stocks-A Complete Trading System by JB Marwood

About Author

Joe Marwood

Joe Marwood is a seasoned trader and investor specialising in stock trading, stock investing, forex trading and trading systems. He worked as a professional futures trader in London, England, before starting up his own private investment fund in 2012. He now trades a global portfolio of equities using a range of systematic and discretionary methods.

Marwood began his career day trading the FTSE 100 future and German Bund and he worked right through the financial crisis of 2008/2009. He has a passion for building mechanical trading strategies and uses a blend of fundamental and technical analysis to find low-risk investment opportunities and short-term trades.

He was taught by the former head of trading at a leading German investment bank and is also an established financial writer, Udemy course instructor, author of a book on stock trading, and a regular Seeking Alpha contributor.

More From Categories : Stock – Bond trading

Curriculum:

195:” “;}}

“;}}

Reviews

There are no reviews yet.