Courses Infomation

Academy – Advanced Options Trading

Academy – Advanced Options Trading

Archive : Academy – Advanced Options Trading

Take the next step in your options trading abilities by building on your knowledge of basic options trades. Learn how to manage payoffs, probabilities, and risk just like the best options traders. This course includes extensive, real-life examples of how to plan and implement advanced options trades.ADVANCED OPTIONS TRADING

What will I learn?

- Discover trading opportunities through evaluating liquidity, market climate and directional trends

- Plan and implement spreads, strangles, straddles, risk-reversal combinations, vertical calls, call backspreads, and protective collar combinations

- Leverage probabilities through the lens of time decay and Delta

- Construct trading hypothesis based on trends to determine which strategy is best to maximize opportunity and increase returns

- Apply technical, fundamental, and sentiment analysis to your options trading.ADVANCED OPTIONS TRADING

This course is for: intermediate to advanced options traders who already have a sound understanding of puts, calls, and basic options strategies..ADVANCED OPTIONS TRADING

Certificate of EnrollmentReceive an Investopedia Academy Certificate of Enrollment with this course

Financial AssistanceStudents and U.S. military may be eligible for reduced pricing. See this page for details about how to apply.

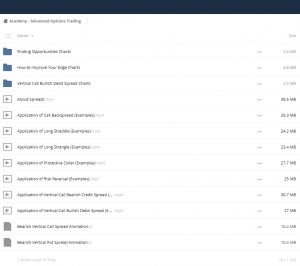

Course Curriculum

Introduction to Options Strategies

- Introduction to Options Strategies

- Review of Spreads and Combinations

- About Spreads

- Review of Debit and Credit Spreads

- Probability: Time Decay & Delta

- Review of Probability

- How Options are Used in the Industry

- Institutional Options Knowledge Check

- Self-Reflection

How to Improve Your Edge in Options Trading

- How to Improve Your Edge in Options Trading

- Types of Analysis to Use Towards Options Trading

- Continuation on Types of Analysis to Use Towards Options Trading

- IAI and VIX

Finding Opportunities in Options Trading

- Finding Opportunities in Options Trading

- Liquidity

- Climate of Options

- Climate: What to Identify

- Directional Market Trends

Vertical Call Debit Spread (Bullish)

- Theoretics of Vertical Call Bullish Debit Spread

- Application of Vertical Call Bullish Debit Spread (Examples)

- Vertical Bullish Call Spread Follow Along Workbook Exercise

- Chart Tips

- Vertical Call Bullish Debit Spread Flashcards

- Vertical Bullish Call Spread Your Turn Workbook Exercise

- Self-Reflection Guide

Vertical Call Credit Spread (Bearish)

- Theoretics of Vertical Call Bearish Credit Spread

- Application of Vertical Call Bearish Credit Spread (Examples)

- Vertical Bearish Call Spread Follow Along Workbook Exercise

- Chart Tips

- Vertical Call Bearish Credit Spread Flashcards

- Vertical Bearish Call Spread Your Turn Workbook Exercise

- Self-Reflection Guide

Risk Reversal Combination

- Theoretics of Risk Reversal

- Application of Risk Reversal (Examples)

- Risk Reversal Follow Along Workbook Exercise

- Chart Tips

- Risk Reversal Combination Flashcards

- Risk Reversal Your Turn Workbook Exercise

- Self-Reflection Guide

Long Straddle Combination

- Theoretics of Long Straddle

- Application of Long Straddle (Examples)

- Chart Tips

- Long Straddle Combination Flashcards

- Long Straddle Follow Along Workbook Exercise

- Long Straddle Your Turn Workbook Exercise

- Self-Reflection Guide

Long Strangle Combination

- Theoretics of Long Strangle

- Application of Long Strangle (Examples)

- Chart Tips

- Long Strangle Combination Flashcards

- Long Strangle Follow Along Workbook Exercise

- Long Strangle Your Turn Workbook Exercise

- Self-Reflection Guide

Call Backspread

- Theoretics of Call Backspread

- Application of Call Backspread (Examples)

- Chart Tips

- Call Backspread Flashcards

- Call Backspread Follow Along Workbook Exercise

- Call Backspread Your Turn Workbook Exercise

- Self-Reflection Guide

Protective Collar Combination

- Theoretics of Protective Collar

- Application of Protective Collar (Examples)

- Chart Tips

- Call Backspread Flashcards

- Protective Collar Follow Along Workbook Exercise

- Protective Collar Your Turn Workbook Exercise

- Self-Reflection Guide

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Academy – Advanced Options Trading

More From Categories : Forex – Trading & Investment

Curriculum:

193:” “;}}

“;}}

Reviews

There are no reviews yet.