Courses Infomation

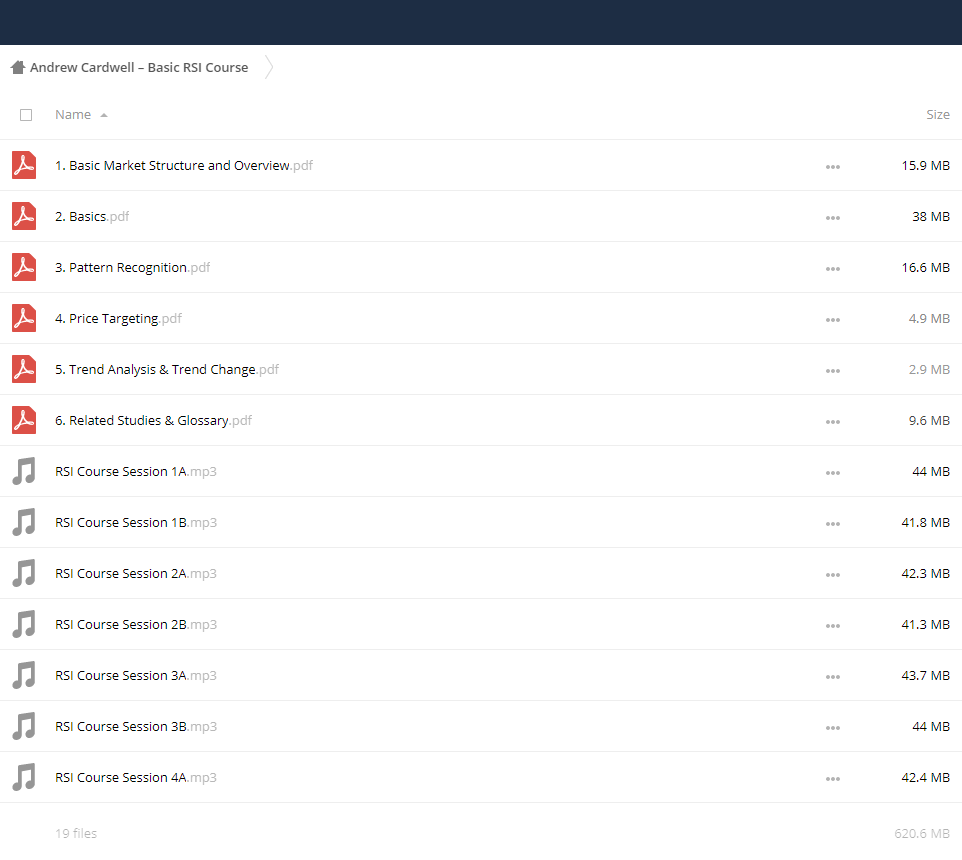

Andrew Cardwell – Basic RSI Course

Andrew Cardwell – Basic RSI Course

Merchandise Description

Range Rules, Divergences, Positive/Negative Reversals, Reward/Risk, Probability, Money Management, and Psychology are all covered in further detail in the Basic RSI Course, which is a 125 page handbook with 13 audio CDs (11 hours) in length.

The Basic RSI Course is like having the entire cake plus the recipe to create another one, whereas RSI Explained is only an introduction and a piece of cake.

Program Outline

A. Basic

I. What the Relative Strength Index Means (RSI)

II. Time Period Selection and RSI Calculation

Quick Term

Term Intermediate

Over time

III. RSI Trend Analysis Parameters

Cost of RSI

Typical Range

Crow Range

Brown Range

Oversold or overbought

‘The Signal Count’ and Divergence, Chapter IV

Momentum Lows and Highs

Bullish\sBearish

Degrees of: Short-, Middle-, and Long-Term

Indicator Count

V. Reversals of the Positive/Negative

Bullish Divergence versus Positive Reversal

Bearish Divergence versus Negative Reversal

6. Fundamental Trend Analysis Principles

Uptrends\sDowntrends

Moveable Averages

Moving Averages, or VII

Close Price and RSI Value

Weighted (W), Exponential (E), and Simple (S) (E)

Values to Consider for Moving Averages

8. A bullish attitude

Upward and downward trends

Sentiment Trend

Time Cycles (Days, Weeks, Months & Years)

Measurements Coincident Cycles Helpful for Positive & Negative Reversal Windows with 4, 9, 13, and 26

Price Range or High/Low Cycles

Based on a Range (Week, Day, Hour)

50% retracement

Fibonacci: 38.2, 61.8 Gann: 1/8th, 1/3rd

B. Recognition of Patterns

I. Patterns of Divergence

Bullish\sBearish

II. Patterns of Reversal

Reversals in the favor

Unfavorable Reversals

Third: Intermediate Trend Change Hidden Signal

Positive Divergence

Pessimistic Divergence

IV. Oversold / Overbought

Intermediate to long-term support for upward trends

Positive Reversals that Are Long-Term to Intermediate

Positive Top-Down Reversals at Intermediate to Long Term Intervals

V. Overbought / Oversold

Intermediate to long-term resistance for downward trends

Long-Term Negative Reversals: Intermediate

Bottom-Top Negative Reversals with Intermediate to Long-Term Trends

C. Positive and Negative Reversal Price Targeting

Naked Signals, I

2. Improved Signals

D. Checklist for Trend Analysis and Trend Change

I. Rising Trends Reverse Trends

II. Reverse Trends

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Andrew Cardwell – Basic RSI Course

About Author

Andrew Cardwell

Andrew Cardwell, president of Cardwell RSI EDGE, Inc., began his trading career in 1978 as a broker with McCormick Commodities. In 1981, he left the brokerage business to devote his time to the study of technical analysis and to develop a trading program and model around the relative strength index. Today, Mr. Cardwell provides consultation and commentary for his RSI course students and his Cardwell Private Client Group. He has taught his proprietary RSI Basic and RSI EDGE courses to individual traders, brokers, money managers, and technical analysts from around the globe. More than 70% of Mr. Cardwell’s students have been referrals, and he has students in 27 countries. As a very respected and sought-after lecturer, he has presented at some of the most prestigious worldwide financial conferences. From 1990 to 1995, he provided weekly market commentary for the Financial News Network and has also appeared on CNBC, providing opinions based on his RSI experience. During an appearance on FNN, John Bollinger referred to Mr. Cardwell as “Dr. RSI.” His articles have been published in Futures magazine and by Knight-Ridder News Service. Mr. Cardwell was featured in the Commodity Traders Consumer Reports “Trader Profile” series, where Bruce Babcock referred to him as “the world’s leading authority on the RSI.”

More From Categories : Forex – Trading & Investment

More Infomation About Author: Andrew Cardwell

Curriculum:

Reviews

There are no reviews yet.