Courses Infomation

Charles Cottle (The Risk Doctor) – Introduction to Advanced Options Trading – 201

Charles Cottle (The Risk Doctor) – Introduction to Advanced Options Trading – 201

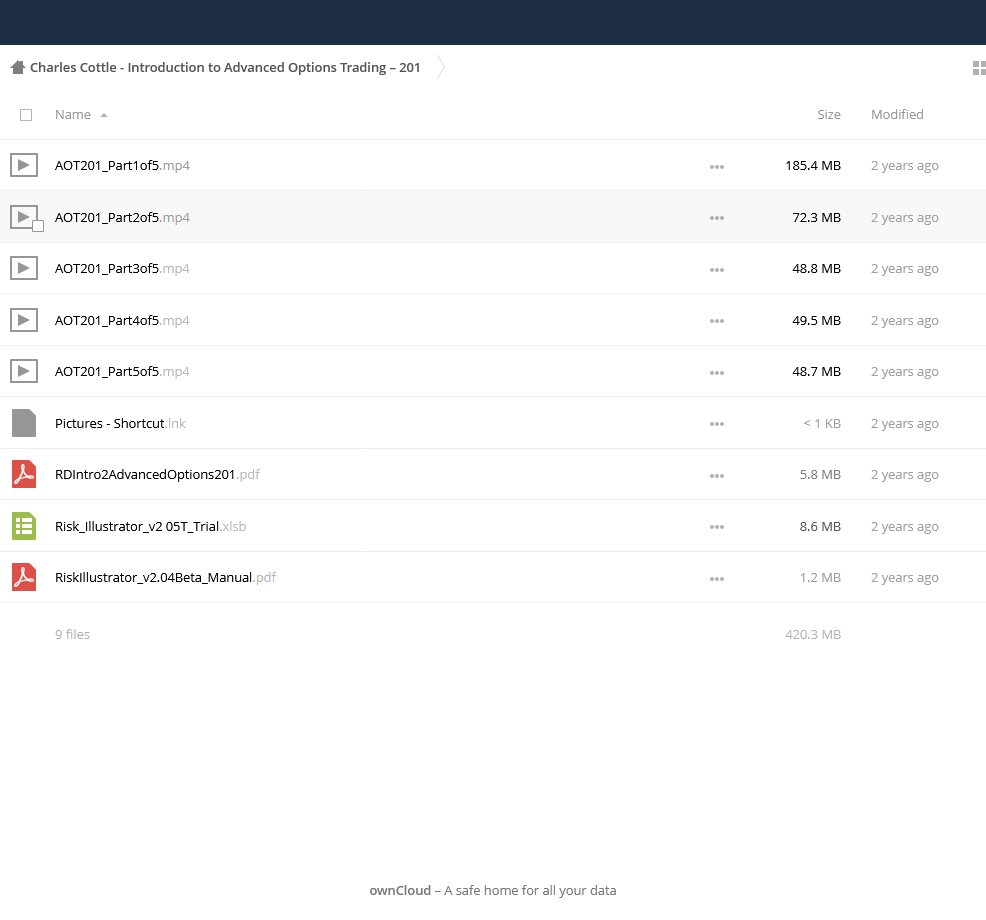

Charles Cottle (The Risk Doctor) – Introduction to Advanced Options Trading – 201 [5 Videos (MP4) + 2 Documents (PDF) + 1 Workbook (XLSB)]

Introduction to Advanced Options Trading – 201 is the second options trading class in RiskDoctor’s “Come Hedge With Me” Options Strategist Series. It is an update of The Options metamorphosis course that achieved the highest accolades from beginner, intermediate and advanced students. Many simply said “it was this course that finally made the lights come on for me”.

This 5 part video course totals nearly 90 minutes and is based on Charles Cottle’s book, “Options Trading: The Hidden Reality”; Chapter 2, “A JUST CAUSE FOR ADJUSTMENTS”.

Introduction to Advanced Options Trading 201 explains the relationship between the many choices available to an investor or trader, for the purpose of adjusting a position.

In this CAUSE and EFFECT universe there are newsletters, advisors and even brokers (the CAUSE) telling their students and investors (the EFFECT) what positions to put on to make money, but it mostly stops there, doesn’t it? RiskDoctor’s Introduction to Advanced Options Trading 201 raises the bar about position ADJUSTMENTS and opinion development allowing YOU to become the CAUSE.

Escape being the EFFECT of newsletters, advisors and tipsters. Be the CAUSE of your own destiny.

What is Stock?

Stock (also capital stock) is all of the shares into which ownership of a corporation is divided. In American English, the shares are collectively known as “stock”. A single share of the stock represents fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the stockholder to that fraction of the company’s earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued for example without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

What is Trading Market

Trade Marketing is also called B2B marketing or business-to-business marketing. All the promotional activities are aimed at increasing the demand of the product among the various supply chain partners.

By doing so, a manufacturer attempts to ensure the consistent supply and availability of the product to the end consumer. Incentives are given to the intermediaries for effective promotion of the product at their end.

Various forms of promotion at the retailer end include activities such as – ensuring prominent display of the product, branded merchandise, more shelf space, and even word of mouth also does the trick.

Salepage : Charles Cottle (The Risk Doctor) – Introduction to Advanced Options Trading – 201

More From Categories : Others Methods

Curriculum:

194:” “;}}

“;}}

Reviews

There are no reviews yet.