Courses Infomation

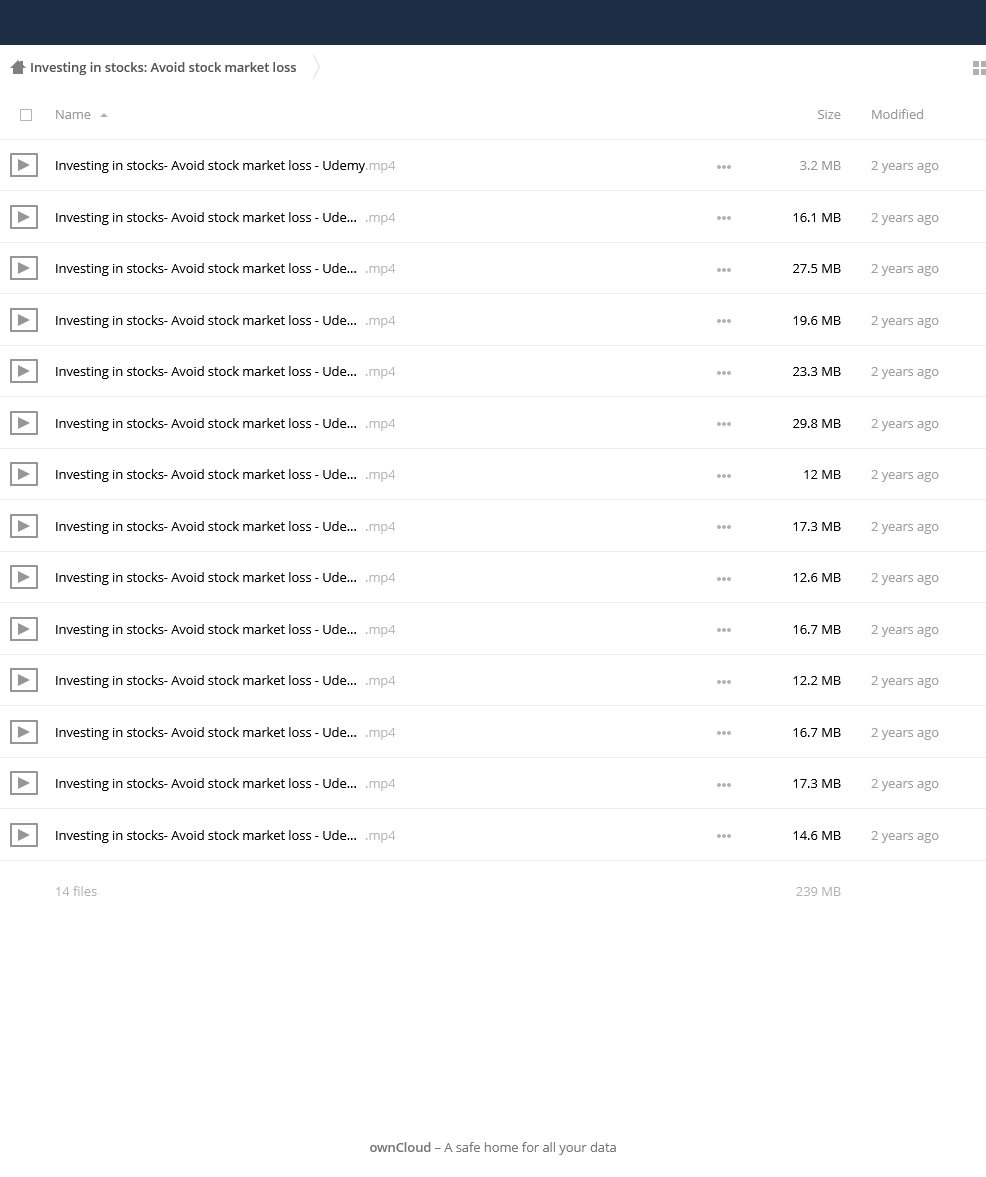

Investing in stocks: Avoid stock market loss

Investing in stocks: Avoid stock market loss

**More information:

Description

If you are an investor, trader or even a business owner, how would you like to be able to forecast the next recession? You could avoid losing money on the stock market. You could decide how to divert your investments before anything happens.

In this course, I will teach a certain exact method to forecast the next recession. This particular method successfully foretasted the early 1990s recession, the tech bubble in 2000, and the financial crisis in 2008.

So Who is this course for?

This course is made for investors, traders and business executives who want actionable knowledge on the state of economy.

Unlike some other courses out there where you just hear instructors talking endlessly, and you only see text in their power point presentation, this course will include animations, images, charts and diagrams help you understand the various concepts.

This course includes a basic concept section. So if you have 0 knowledge, you will be able to catch up.

I promise I will not be teaching generic unactionable ideas like you must buy low and sell high. Also, this is also not a motivation class where I preach to you that you must work hard to succeed, or you must have discipline to profit from the market.

In this course, I will teach you the exact methods, how to execute them, and where to search for resources.

In addition, Udemy and I promise a 30 day money back guarantee so you have absolutely no risk. If I fail to deliver up to your expectations, you can have your money back after attending the course. No questions asked.

So what are you waiting for? Its time to take action! Go ahead to click on the enroll button. I will see you at our course.

- This course is target at investors, traders or business executives who have vested interest in the economy.

Stock trading course: Learn about Stock trading

A stock trader or equity trader or share trader is a person or company involved in trading equity securities.

Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker.

Such equity trading in large publicly traded companies may be through a stock exchange.

Stock shares in smaller public companies may be bought and sold in over-the-counter (OTC) markets.

Stock traders can trade on their own account, called proprietary trading, or through an agent authorized to buy and sell on the owner’s behalf.

Trading through an agent is usually through a stockbroker. Agents are paid a commission for performing the trade.

Major stock exchanges have market makers who help limit price variation (volatility) by buying and selling a particular company’s shares on their own behalf and also on behalf of other clients.

What is forex?

Quite simply, it’s the global market that allows one to trade two currencies against each other.

If you think one currency will be stronger versus the other, and you end up correct, then you can make a profit.

If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting.

Foreign Exchange

You go up to the counter and notice a screen displaying different exchange rates for different currencies.

An exchange rate is the relative price of two currencies from two different countries.

You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!”

When you do this, you’ve essentially participated in the forex market!

You’ve exchanged one currency for another.

Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen.

Currency Exchange

Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed.

It’s these changes in the exchange rates that allow you to make money in the foreign exchange market.

Salepage : Investing in stocks: Avoid stock market loss

More From Categories : Forex – Trading & Investment

Curriculum:

195:” “;}}

“;}}

Reviews

There are no reviews yet.