Courses Infomation

Precision Timing Secrets from Simplertrading

Precision Timing Secrets from Simplertrading

Archive :Precision Timing Secrets from Simplertrading

It does no good to be right on a great trading idea if you get the timing all wrong. Sometimes just being off by a single day can get you stopped out of a winner. So whether you’re a day-trader or a swing trader, precise timing can make the difference between consistent profits and going bust.

That’s why it’s so critical to take a few minutes before every trade to see if your entry lines up with significant Fibonacci Timing cycles. Once you see how uncannily accurate these simple timing calculations can be, you may never want to trade without them again.

Because most traders don’t have a clue about Fibonacci timing, you can get a serious edge just by learning a few simple timing techniques. Here’s just some of what you’ll discover:

- How Fibonacci timing & price analysis can help to identify major reversals weeks in advance so you can make better trading decisions

- Exactly how these timing techniques work using recent market examples so you understand how they line up over and over again with key reversals

- How to apply precise Fibonacci timing analysis to your entries and exits to add a powerful edge to your trading decisions

- Actionable market timing points in the coming weeks that you can potentially take advantage of in real-time

- Trading Day cycles in both Think or Swim and Dynamic Trader platforms

- Trade live with Fibonacci Queen, Carolyn Boroden and income generating specialist, Bruce Marshall as they tag-team the markets in this special (1st time ever) live trading event.

What is Technical Analysis?

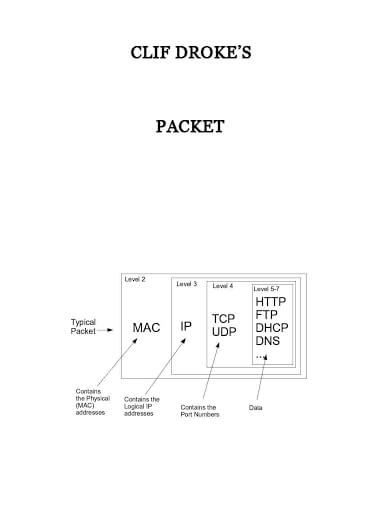

Technical analysis is a means of examining and predicting price movements in the financial markets, by using historical price charts and market statistics. It is based on the idea that if a trader can identify previous market patterns, they can form a fairly accurate prediction of future price trajectories.

It is one of the two major schools of market analysis, the other being fundamental analysis. Whereas fundamental analysis focuses on an asset’s ‘true value’, with the meaning of external factors and intrinsic value both considered, technical analysis is based purely on the price charts of an asset. It is solely the identification of patterns on a chart that is used to predict future movements.

Salepage : Precision Timing Secrets from Simplertrading

More From Categories :Technical Analysis Courses

Curriculum:

157:” “;}}

“;}}

Reviews

There are no reviews yet.