Courses Infomation

Quantitative Technical Analysis by Dr Howard B Bandy

Quantitative Technical Analysis by Dr Howard B Bandy

**More information:

Sale Page

This book, the fifth by Dr. Howard Bandy, discusses an integrated approach to trading system development and trading management.

It begins with a discussion and quantification of the several aspects of risk.

1. The trader’s personal tolerance for risk.

2. The risk inherent in the price fluctuations of the issue to be traded.

3. The risk added by the trading system rules.

4. The trade-by-trade risk experienced during trading.

An original objective function, called “CAR25,” based on risk-normalized profit potential is developed and explained. CAR25 is as near a universal objective function as I have found.

The importance of recognizing the non-stationary characteristics of financial data, and techniques for handling it, are discussed.

There is a general discussion of trading system development, including design, testing, backtesting, optimization, and walk forward analysis. That is followed by two parallel development paths — one using traditional trading system development platform and the second machine learning.

Recognizing the importance of position sizing in managing trading, an original technique based on empirical Bayesian analysis, called “dynamic position sizing” and quantified in a metric called “safe-f,” is introduced. Computer code implementing dynamic position sizing is included in the book.

SIZE: 180 MB

What is Technical Analysis?

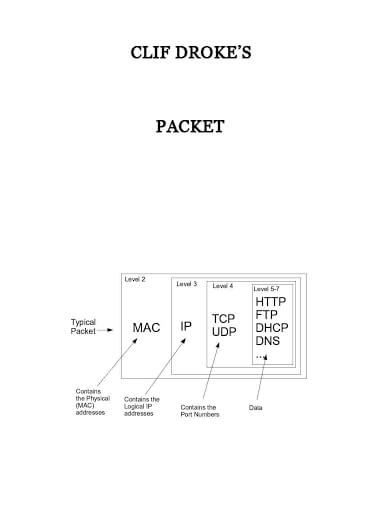

Technical analysis is a means of examining and predicting price movements in the financial markets, by using historical price charts and market statistics. It is based on the idea that if a trader can identify previous market patterns, they can form a fairly accurate prediction of future price trajectories.

It is one of the two major schools of market analysis, the other being fundamental analysis. Whereas fundamental analysis focuses on an asset’s ‘true value’, with the meaning of external factors and intrinsic value both considered, technical analysis is based purely on the price charts of an asset. It is solely the identification of patterns on a chart that is used to predict future movements.

Salepage : Quantitative Technical Analysis by Dr Howard B Bandy

About Author

Doug Sutton

Accomplished general management executive with an outstanding track record of results to increase share and revenue. Experienced in creating a vision and implementing coordinated programs to cultivate a business unit’s destiny. Well-organized, dynamic leader of diverse functional teams that develop and grow differentiated branded products, penetrate new markets and exceed required growth and profit objectives.

Specialties: Leadership, communication, inspiration, motivation.

Business and marketing strategy, implementation, branding and positioning, pricing, product development, channel development, org design

More From Categories : Technical Analysis Courses

Curriculum:

159:” “;}}

“;}}

Reviews

There are no reviews yet.