Courses Infomation

Stewart Patton – Tax Savvy US Expat Entrepreneur

Stewart Patton – Tax Savvy US Expat Entrepreneur

Archive : Stewart Patton – Tax Savvy US Expat Entrepreneur

ENTREPRENEUR: COMPLETE TAX AND LEGAL STRUCTURING SOLUTION FOR LOCATION-INDEPENDENT ENTREPRENEURS

Living outside the US creates an awesome opportunity to own and operate your own location-independent business and pay no or very little tax. But actually understanding and implementing this opportunity can be difficult.

THE JUNGLE GETS THICKER

Once you start putting together your own location-independent business as an expat or digital nomad, the complications intensify.

Now you have all sorts of issues to figure out:

- Can I operate my business through a non-US corporation?

- If so, what’s the best jurisdiction in which to form my non-US corporation?

- How do I set up a non-US corporation without getting scammed?

- Can I still bank in the US?

- How can I open a US bank account under a non-US corporation?

- What are the exact US tax consequences of using this structure?

- How exactly do I operate a business under a legal entity?

- How can I invest for retirement ?

- How do I report all this on my US tax return?

- Will I still have to pay state tax?

- And what about non-US tax?

THE PATHS GET MORE TREACHOROUS

Let’s look at different ways to answer these questions.

The IRS provides absolutely no help at all. IRS Publication 54 doesn’t discuss which legal structures are best in particular situations, and of course the IRS can’t tell you how to form a non-US corporation. The IRS is just silent on all these issues.

Then, the internet is full of unreliable yammering about these issues. The nuggets of good advice are buried under so many layers of supposition and contradiction that it would take you hours and hours to find the gold. You’ll be so fed up at that point that you wouldn’t recognize it.

Also, the crocodiles are thicker and meaner in this part of the jungle. All sorts of “offshore gurus” and fly-by-night incorporation services are looking to sell you a useless and over-complicated structure at an exorbitant rate.

Now, of course I have a package of services for location-independent entrepreneurs where I take care of everything for you. But I’m extremely busy and I get new inquiries all the time, so I charge several thousand dollars per year. Unfortunately, my services aren’t really accessible to many bootstrapped startups and early-stage lifestyle businesses.

A BETTER WAY

That’s why I created the Tax-Savvy Expat Entrepreneur course.

My first online course, Tax-Savvy Expat Essentials, shows you how the tax rules create the opportunity to own a location-independent business and pay no or very little tax. Now, Entrepreneur shows you exactly how to take full advantage of this opportunity.

Beyond just discussing the tax rules, Entrepreneur also provides:

- a step-by-step guide to actually creating the proper legal structure for your situation,

- direct links to the people and resources you need to form your legal structure, and

- the actual legal documents you need to get your legal structure together.

Plus, your purchase of Entrepreneur includes a one-hour consultation call. We’ll go over your particular situation and make sure you understand exactly how to move forward.

Entrepreneur is an complete actionable resource that contains everything you need to actually get your own legal structure up and running in as little time as possible.

The course contains the same information I provide my clients and the same resources and legal documents I use to get the job done.

WHO THIS COURSE IS FOR

Entrepreneur is designed to help digital nomads and expat entrepreneurs who own and operate a location-independent business.

You own a “location-independent business” when (i) you sell something other than your own time (such as other people’s time, physical or digital products, advertising space, or access to software) and (ii) you aren’t tied to an on-the-ground location in any particular country.

Common examples of location-independent businesses include the following:

- affiliate marketing,

- digital agency,

- web hosting,

- niche websites,

- ad-based internet publishing businesses (such as a blog, podcast, or YouTube channel),

- SaaS and SwaS businesses,

- e-commerce businesses (such as Amazon FBA, drop-shipping), and

- traffic arbitrage.

One caveat here: the legal structure discussed in Entrepreneur does not work for businesses with a US-based founder or that operate using employees or dependent agents located in the US. However, it’s perfectly fine to use the services of a third party running their own business in the US.

HERE’S HOW IT WORKS

Entrepreneur consists of nine video lectures where I talk over professionally designed slides. The lectures total up to 1.5 hours (but you can speed up or slow down the playback if you like).

You have instant and continuous access to the whole course, so you can go back and review whenever you have a question.

Each section also has notes that provide additional detail on the subject matter of each lecture and contain links to the resources you need to organize your structure.

Finally, the actual legal documents you need are attached right in the part of the course where they’re discussed and at the end (so you have easy access to everything when you’re done).

TABLE OF CONTENTS

Here are the nine lessons that comprise Entrepreneur:

- Course Overview

- Tax-Savvy Expat Entrepreneur Structure: Introduction

- Tax-Savvy Expat Entrepreneur Structure: Formation

- Tax-Savvy Expat Entrepreneur Structure: Operation

- US Tax Consequences: Business Income

- US Tax Consequences: Investment Income

- US Tax Reporting and Accounting

- State Tax and Non-US Tax

- Next Steps

INVEST IN YOUR SUCCESS

You’ve spent time and money to figure out your business and increase your revenue, right? Well, plugging tax leaks in your legal structure is even more important.

It’s not just about the money you make, it’s about the money you keep. Investing in the right legal structure pays a return year after year by legally keeping more money in your pocket.

In fact, several of my students use what they learned in Entrepreneur to easily save $25,000 or more in tax, every single year.

ENTREPRENEUR SHOWS YOU:

How to minimize US federal income tax, US self-employment tax, state tax, and non-U.S. tax;

How to determine the best legal structure for your particular situation;

How to actually create that legal structure (with an easy step-by-step guide and the actual resources and legal documents you need); and

How to operate your business under that legal structure.

In addition to everything described above, your purchase of Entrepreneur includes a one-hour consultation. We can apply what you learn in Entrepreneur to your particular situation and make sure you have all the tools you need to get your own structure together.

The legal structure you put together after taking this course will pay you year after year in legal US tax savings.

Even beyond that, Entrepreneur really pays for itself immediately. Here’s why:

- you’ll save tons of time scouring the internet and talking with experts to figure this all out on your own;

- you’ll avoid the expensive and well-marketed entity formation services-easily saving you the entire cost of this course in your first year; and

- you’ll save the lawyer fees necessary to create the legal documents included in this course.

Also, as an added bonus, your purchase of Entrepreneur gives you free access to both Essentials and Freelancer.

YES, I WANT TO BECOME A TAX-SAVVY EXPAT ENTREPRENEUR! -$800

“Thanks for the great course. I loved how simple everything was to follow.”

–Brian K.

“Wow, thanks so much for putting this course together! I was going crazy trying to figure this all out on my own, I wish I had found your course sooner!

It’s absolutely worth its weight in gold. I had been reading articles on the internet, and I even had a couple of initial consultations with people who are supposed to understand this stuff, but they didn’t really help me, and they charged a LOT of money just to form an offshore company.

This course was the glue I needed to hold everything I’ve been reading all together. It’s allowed me to get my legal structure all set up so I can concentrate on my business.”

-Britany S.

“A really excellent resource. I had some doubts before buying it, normally I wouldn’t spend this much money just on information, but I figured I’d give it a shot since it has a money-back guarantee. After taking the course, I figured out that it’s much more than just information-it includes legal documents I used for my structure, and it has contact info for the people to contact to set everything up. This is what I needed to finally get me over the hump and set up a proper legal structure for my business. It’s just an awesome resource for location-independent entrepreneurs.”

-James L.

“This course saved me $15,000 in my first year of business by showing me how to set up a structure to get around the self-employment tax. Can’t recommend it enough!”

-Brian H.

YES, I WANT TO BECOME A TAX-SAVVY EXPAT ENTREPRENEUR! -$800

RISK-FREE MONEY-BACK GUARANTEE

I’m absolutely sure you’ll find tons of value in each of the Tax-Savvy Expat courses. But I want you to feel confident about that too. That’s why I’m including a risk-free money-back guarantee.

If you don’t get exactly what you expect from a Tax-Savvy Expat course, for any reason, just drop me an email within 30 days. I’ll send you a full refund, no questions asked.

Salepage : Stewart Patton – Tax Savvy US Expat Entrepreneur

About Author

Stewart Patton

Hi, I’m Stewart Patton, US tax attorney and expat entrepreneur.

I specialize in helping US citizens who live or invest outside the United States understand and optimize their tax situations.

Because, let’s face it: nobody chooses to live, travel or invest abroad so they can spend time worrying about complex loopholes and tax traps. And trying to figure this all out on your own is just a recipe for headaches and potential disaster.

That’s why my clients trust me to handle the tricky stuff—so they can spend more time doing what they do best.

With over 15 years of experience solving US tax problems, I provide watertight US tax advice and help structure your business and investments efficiently. You can sleep easy knowing that your US tax is minimized and everything is reported properly to the IRS.

I specialize in de-mystifying the sometimes-thorny subject of US tax. It’s my aim to make things simpler and clearer for you while saving you time and money.

I grew up in Midwest City, Oklahoma, then attended Texas A&M University and the University of Houston Law Center (graduating magna cum laude and Order of the Coif). I practiced for 12 years as a tax attorney in three large law firms, culminating as a partner in the Chicago office of Kirkland & Ellis LLP.

One cold winter morning, I heard the same little voice you may have heard: “There must be more to life than going to work while it’s cold and dark and the kids are in bed only to return home when it’s cold and dark and the kids are in bed.”

Thankfully, my wife is from Belize, where it’s sunny almost every day and the temperature sometimes dips into the high 60s when a cold front passes through.

So, I told my firm about the new life my family and I had chosen, we packed up the house, and I continued practicing US tax law as a solo practitioner in Belize.

I help Americans who live or invest abroad understand how US tax applies to them, properly structure their businesses and investments, and comply with the complicated disclosure requirements that only get stricter every year.

More From Categories : Internet Marketing Courses

More Infomation About Author: Stewart Patton

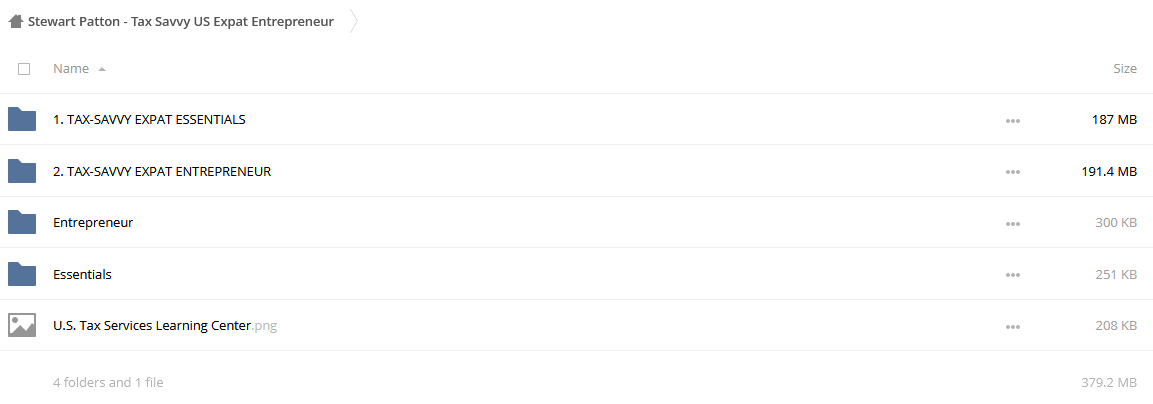

Curriculum:

158:” “;}}

“;}}

![Peter Titus - Create Your Own Automated Stock Trading Robot In EXCEL! [39 Video (MP4) + 2 Document (HTML)]](https://crablib.info/wp-content/uploads/2021/02/Peter-Titus-Create-Your-Own-Automated-Stock-Trading-Robot-In-EXCEL-39-Video-MP4-2-Document-HTML.jpg)

Reviews

There are no reviews yet.